In 2021, Italy experienced strong growth in the residential ventilation market, compared with 2020. This growth was driven in part by the governmental incentive packages available for the renovation of buildings and largely by the high energy efficiency targets linked to the design of the heating, ventilation, and air conditioning (HVAC) equipment in new or renovated buildings.

This in turn depends on a new decarbonized vision of Europe that is emerging. The vision takes into consideration the fact that most of the housing stock in the European Union (EU) is old and inefficient and is responsible for around 40% of energy consumption and 36% of greenhouse gas (GHG) emissions in the area. Restructuring the building stock is, therefore, an essential measure for decarbonization, at the heart of the Roadmap 2050 of the EU member states.

Ventilation in European buildings has been developing along with the development of nearly Zero Energy Buildings (nZEBs). nZEBs are now mandatory under the European Directive (EU) 2018/844, which stipulates that all new buildings and major renovations must fall within the framework of the highly efficient nZEB building concept. These efficient buildings, both residential and non-residential, adopt mechanical ventilation, which is a very important factor for comfort and energy savings.

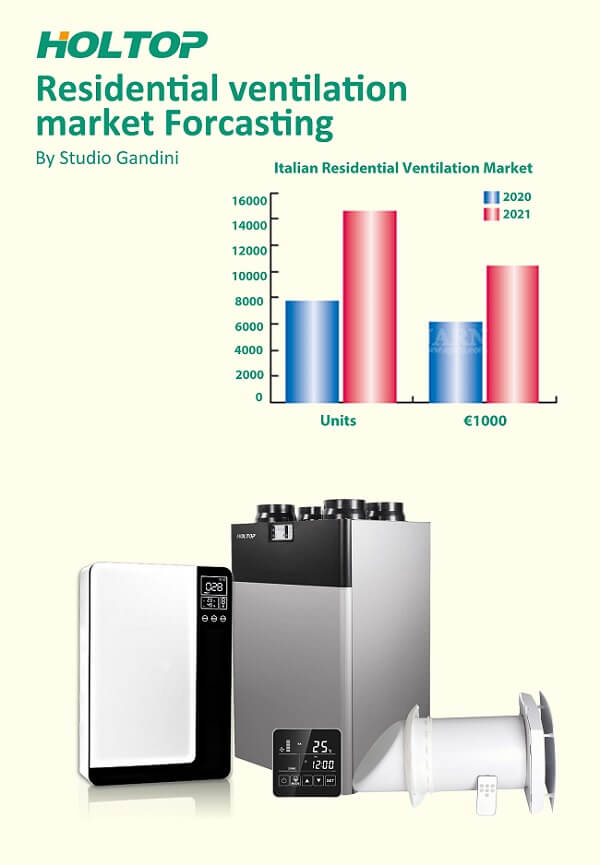

Italy 2020 vs 2021

The Italian residential ventilation market increased by about 89% from 7,724 units in 2020 to 14,577 units in 2021, and also increased by about 70% from €6,084,000 (about US$ 6.8 million) in 2020 to €10,314,000 (about US$ 11.5 million) in 2021 as shown in Fig. 1, showing rapid growth, according to the Assoclima statistical panel.

The Italian residential ventilation market data in this report are based on an interview with Eng. Federico Musazzi, secretary general of Assoclima, the Italian association of manufacturers of HVAC systems federated to ANIMA Confindustria Meccanica Varia, the Italian industrial organization that represents companies operating in the mechanical engineering sector.

Since 1991, Assoclima has been drawing up an annual statistical survey on the market for components of air conditioning systems. This year, the association newly added the residential ventilation segment, including dual flow and single house/dwelling central heat recovery ventilation systems, to its data collection and created a well-established HVAC statistic report recently.

Because this was the first year of collection of data on residential ventilation, it is possible that the collected values do not represent the entire Italian market. Therefore, in absolute terms, the sales volume of residential ventilation systems in Italy could be considerably higher than that represented in the statistic.

Europe: 2020 ~ 2025

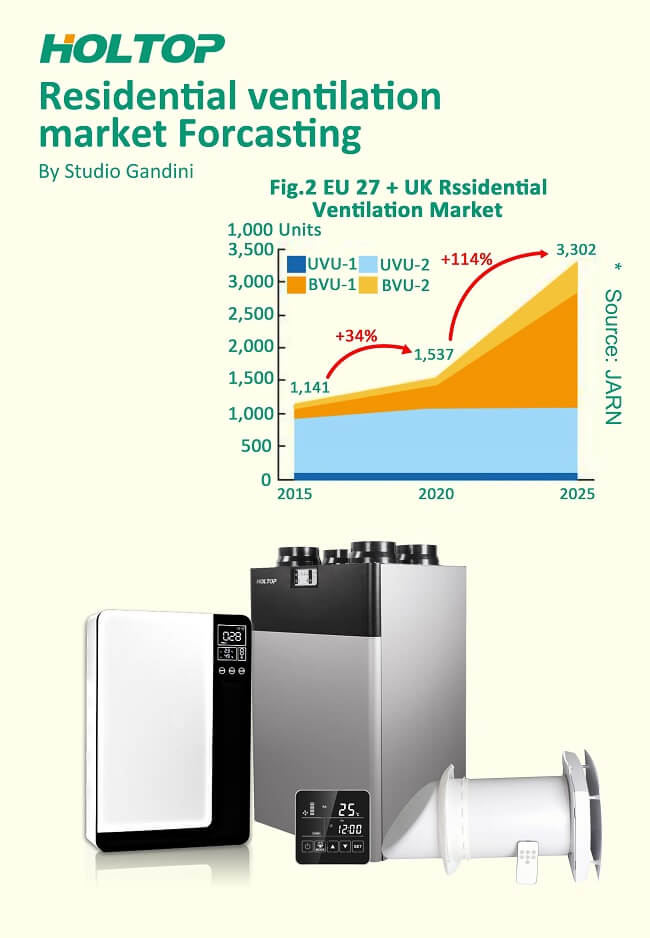

Studio Gandini forecasted that the residential ventilation market in the EU 27 countries and the United Kingdom will double in 2025 compared with 2020, growing from about 1.55 million units in 2020 to 3.32 million units in 2025, in its report, ‘Residential and Non-residential Ventilation: Multiclient Market Intelligence Report – European Market 2022’. The residential ventilation market in the report consists of centralized and decentralized units for single houses and apartments, mainly with dual flow and cross flow heat recovery.

As shown in Fig. 2, during the period spanning 2020 to 2025, the report foresees great development for ventilation, air renewal, air purification, and air sanitation inside buildings, which will offer major business opportunities for manufacturers of air handling units (AHUs), commercial ventilation units, and residential ventilation units that make buildings healthier and more sustainable.

Following the first edition in 2021, Studio Gandini published the second edition of the report this year. The first and second research projects are totally dedicated to the air renewal, air purification, and air sanitation markets, in order to objectively grasp the market volume and value in the EU 27 countries and the United Kingdom.

For the residential heat recovery ventilators, Holtop developed some residential HRVs for customers to choose, which are wall-mounted erv, vertical erv and floor-standing erv. In the face of COVID-19 situation, Holtop also developed fresh air sterilizaiton box with ultraviolet gremicidal, which could intensity to kill bacteria and viruses in a short time.

If you are interested in any products and wanna get more information, please send us an inquiry or click the instant chat app at the right bottom to get more information.

For more information, please view: https://www.ejarn.com/index.php

Post time: Jul-07-2022